Get the free sf428a form

Show details

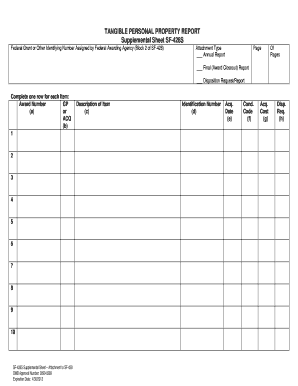

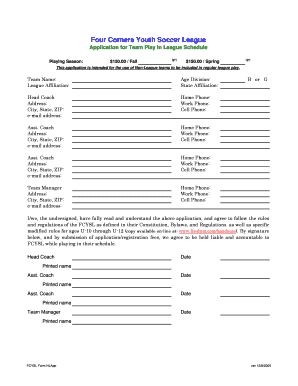

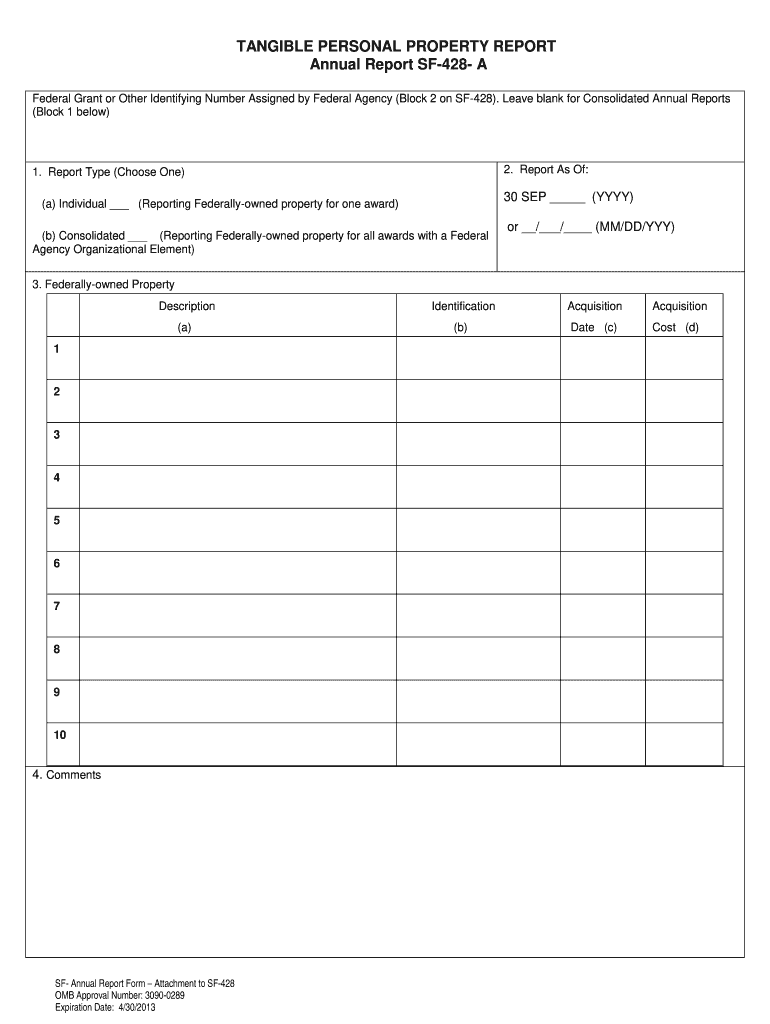

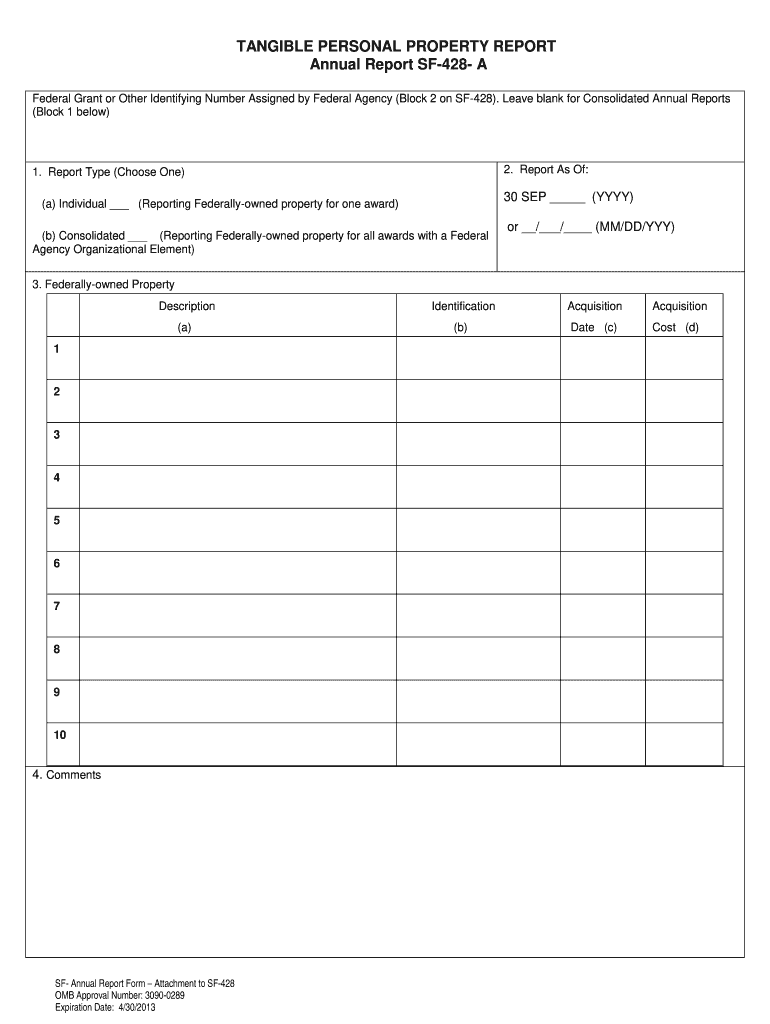

TANGIBLE PERSONAL PROPERTY REPORT Annual Report SF-428- A Federal Grant or Other Identifying Number Assigned by Federal Agency Block 2 on SF-428. Federally-owned Property Description Identification Acquisition a b Date c Cost d 4. Comments SF- Annual Report Form Attachment to SF-428 OMB Approval Number 3090-0289 Expiration Date 4/30/2013 Instructions for Federally Owned Property Annual Report SF-428 Attachment A A. Select b Consolidated to report Federally-owned property for all awards with...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sf428a form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sf428a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sf428a online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sf 428 a fillable form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out sf428a form

How to fill out sf428a:

01

The first step is to gather all the necessary information and documents required to fill out sf428a. This includes personal identification details, income details, and any relevant supporting documents.

02

Start by carefully reading the instructions and guidelines provided with the sf428a form. This will help you understand the specific requirements and ensure accurate completion.

03

Begin filling out the basic information section of the sf428a form. This includes providing your name, address, contact details, and any other required personal information.

04

Move on to the income section of the form. Here, you will need to provide details about your sources of income, such as employment, investments, rental properties, or any other relevant income streams. Be sure to provide accurate and up-to-date information.

05

If you have any deductions or exemptions, make sure to include them in the appropriate section of the form. This could include deductions for dependents, education expenses, or any other eligible deductions. Make sure to provide any necessary documentation to support these deductions.

06

After completing all the necessary sections of the sf428a form, double-check all the information provided for accuracy and completeness. It is important to ensure that there are no errors or missing information that could potentially delay or affect the processing of your form.

07

Once you are satisfied with the accuracy of the form, sign and date it in the designated section. Keep a copy of the completed sf428a form for your records.

Who needs sf428a:

01

Individuals who are self-employed or have freelance income may need to fill out sf428a. This form helps report and calculate self-employment taxes.

02

Independent contractors or individuals who receive income from a variety of sources may also need to complete sf428a to accurately report their earnings.

03

Some individuals who have multiple sources of income, such as rental properties or investments, may be required to fill out sf428a to report their overall income for tax purposes.

Remember that specific requirements may vary based on your jurisdiction and personal circumstances. It is always recommended to consult with a tax professional or refer to the relevant tax authority's guidelines for accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sf428a?

There is no specific reference to an entity or term called "sf428a". It is possible that you may be referring to a specific context or abbreviation that needs more clarification in order to provide a relevant response.

Who is required to file sf428a?

SF428A is a form used by federal agencies to report on subcontracting plans. It is typically required to be filed by prime contractors that have received a federal contract that meets certain criteria. These criteria are determined by the Federal Acquisition Regulation (FAR) and include the type and value of the contract.

How to fill out sf428a?

To fill out Form SF-428A, you will need the following information:

1. Grant information: Provide the grant number, grant name, and the name of the federal agency providing the grant.

2. Recipient information: Include the name of the recipient organization, recipient code, and contact information.

3. Date: Fill in the reporting period start date and end date.

4. Type of report: Indicate whether it is the final report, annual progress report, or a progress report.

5. Accountability Status: Select the appropriate option to indicate if there were any findings that require a management decision or if there were no instances.

6. Budget information:

- Column (1) - Program Income Earned: Report the amount of program income earned during the reporting period (if applicable).

- Column (2) - Cash: Enter the total cash expenditures made by the recipient during the reporting period.

- Column (3) - Stipend/Direct Assistance/In-kind Contributions: Report the total amount of stipends, direct assistance, or in-kind contributions provided by the recipient during the reporting period.

- Column (4) - Other: Report any other costs incurred during the reporting period that are not covered by columns 1, 2, or 3.

- Column (5) - Total: Calculate the total expenditures by adding up columns 2, 3, and 4.

7. Remarks: Include any additional information or explanations related to the report if necessary.

8. Certifying Official: Provide the name, title, and signature of the certifying official who understands and confirms the accuracy of the report.

Once you have gathered all the required information, you can fill out the SF-428A form by entering the data into the appropriate fields. Review the completed form to ensure accuracy and consistency before submitting it to the designated authority or office.

What is the purpose of sf428a?

SF-428A is a form used by federal agencies to collect information about subcontracts awarded to small businesses, small disadvantaged businesses, women-owned small businesses, HUBZone small businesses, veteran-owned small businesses, and service-disabled veteran-owned small businesses. The purpose of this form is to report on the utilization of these types of small businesses in federal contracts. It helps in monitoring the government's efforts to provide opportunities for small businesses and promotes diversity and inclusion in federal procurement.

What information must be reported on sf428a?

The SF 428A is a form used to collect information on various types of federal funding received by non-federal entities. The information that must be reported on this form includes:

1. Entity Information: The name, address, and contact details of the non-federal entity (e.g., organization or institution) receiving the federal funding.

2. Federal Award Information: Details of the federal award, including the award number, awarding agency, and the award's amount, start date, and end date.

3. Entity Project Information: A description of the specific project or program for which the federal funds are being used, including the project title and a brief summary.

4. Project Performance Information:

- Objectives and Measures: The objectives of the project and any performance measures or indicators that will be used to assess progress or success.

- Outputs and Outcomes: The expected outputs (quantifiable products, services, or results) and outcomes (intended impacts or changes resulting from the project) that are anticipated from the project.

5. Project Budget Information:

- Budget Categories: The major budget categories and line item descriptions, which reflect the specific costs associated with the project.

- Budget Amounts: The budgeted amounts for each category, including both federal and non-federal funds.

- Source of Project Funds: The sources of project funding, including federal, non-federal, and other funds.

- Cost Sharing or Matching: If applicable, the cost-sharing or matching requirements for the project, including the amount or percentage that must be provided by the non-federal entity.

6. Other Information: Any additional information that may be required by the awarding agency or specified in the award agreement.

It's important to note that specific reporting requirements may vary depending on the federal funding program, awarding agency, and the terms and conditions of the award.

What is the penalty for the late filing of sf428a?

The penalty for the late filing of SF-428A, also known as the "Report on Federal Property," may vary depending on the specific circumstances and the agency or organization involved. It is best to consult the relevant agency's rules and regulations or contact them directly for accurate information on late filing penalties.

Where do I find sf428a?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sf 428 a fillable form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit sf428a in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing sf 428 a fillable form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the sf428a electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your sf 428 a fillable form and you'll be done in minutes.

Fill out your sf428a form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.